Call Now

+1 (847) 917-4870

Mailing Address

1002 North Milwaukee Avenue, Libertyville, IL 60048

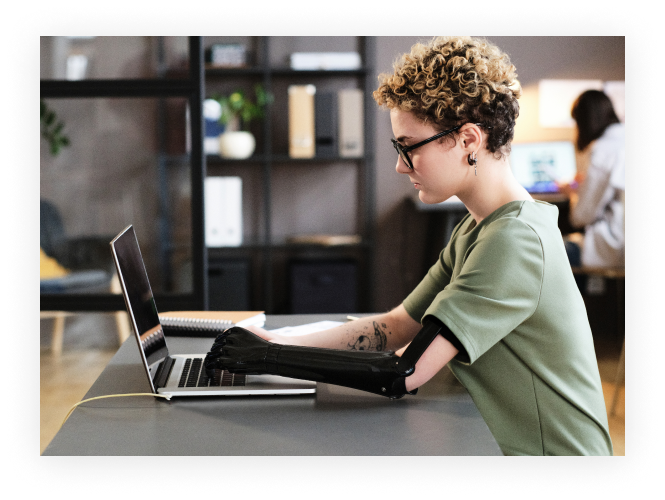

DISABILITY INSURANCE CHICAGO IL

Don’t wait – get your free disability insurance quote today! All you have to do is fill out the simple contact form and I’ll be in touch. Or give me a call at +1 (847) 917-4870

Secure Your Income, Your Lifestyle, and Your Health Care

Protect your future with Disability Income Insurance from Insure Your Future. Our coverage ensures that you and your family are financially secure in the event of an accident or illness that leaves you unable to work. With our coverage, you can rest assured that your income will not stop if you become disabled.

Life insurance is an act of love. Protect your loved ones from financial hardship in the event of your unexpected death by getting a life insurance policy today. Life insurance can help cover funeral costs, provide financial security for children, and help pay off debts – don’t wait, get life insurance now before premiums increase with age!

Don’t wait until it’s too late – secure your future with the right insurance coverage now. Insure Your Future offers short and long-term care insurance to help cover the costs of home or facility care if you become disabled or ill. With more than one in two people needing Extended Health Care, don’t risk leaving your future vulnerable – apply for insurance coverage today!

Disability insurance provides coverage for a wide range of disabilities, including partial disabilities, total disabilities, and catastrophic disabilities. This means that policyholders can be assured of receiving financial assistance in the event of an injury or illness that results in a disability.

Disability insurance policies often offer flexible benefit periods, which means that policyholders can choose their own length of time for receiving benefits. This allows them to tailor their coverage to their needs and ensure they receive the coverage they need.

Affordable Premiums: Disability insurance premiums are usually very affordable, making it a cost-effective way to protect your income against unexpected disability. Premiums are typically based on factors like age, health status, occupation, and other variables such as the type of disability insurance policy chosen.

Catastrophic Disability Insurance / Long-Term Care insurance is an essential protection to protect your portfolio from being reduced to nothing in case of an unexpected illness or injury and the extended healthcare costs. This allows you to concentrate on remaining in your home without worrying about anything as this insurance can help cover the costs of medical care, home care, and other expenses associated with long-term care.

Many long-term care insurance policies qualify for tax deductions or credits for business owners, partnerships, and self-employed businesses. This means that purchasing long-term care insurance may help lower your tax bill at the end of the year, and the benefits are totally tax-free.

A Catastrophic Disability / long-term care insurance policy provides added peace of mind so You Can Live a Worry-Free Life ahead.

+1 (847) 917-4870

1002 North Milwaukee Avenue, Libertyville, IL 60048